How Much Should I Have Saved for Retirement? A Breakdown by Age

When it comes to saving for retirement, there’s a lot of advice out there. You might be looking for a specific amount to save by a certain age, but that answer will vary based on a few different factors.

While exact amounts might vary, we can offer a ballpark figure. To make it easy for you, we’ve summarized the most common advice for you here, so you can get an idea of how much money you should save for retirement depending on your age, lifestyle and current annual salary.

General Rule of Thumb for Retirement Savings: 80%

The consensus is that by the time you retire, you should have saved at least 80% of your salary for each year of your retirement. In other words, if you make $100,000 a year, you should have saved at least $80,000 for each year you’ll be in retirement.

Depending on the lifestyle you hope to lead during retirement and what additional investments you might be able to cash into, this number can vary. It’s a great base to start from to give you an idea of what to aim for, but it’s not very specific. Let’s take a look at how to get to this amount through each decade of your life.

How Much Should You Save Each Year?

How much to save each year depends on when you’re starting to save. If you’re in your early 20s and just starting out, it’s a good idea to put away 15%-25% of your annual income every year. The best option for saving these funds is with a 401K. If you’re young, your job might not offer a 401K, so until you’re able to invest in one, you can save the money in another type of account like an IRA.

However you invest, just try to make it a habit to take a portion of your paycheck and deposit it into an account that will only be used for your retirement savings. When you get at 401K, these funds can be automatically deposited and often include employer matches, helping you save even more.

If you’re older, and for whatever reason have not started saving for retirement, you might need to invest more than 15%-25% each year to reach your retirement goals. Aim for having half of your annual salary saved in a retirement account by 30, twice your salary saved by 40, and then plan on doubling that amount every year.

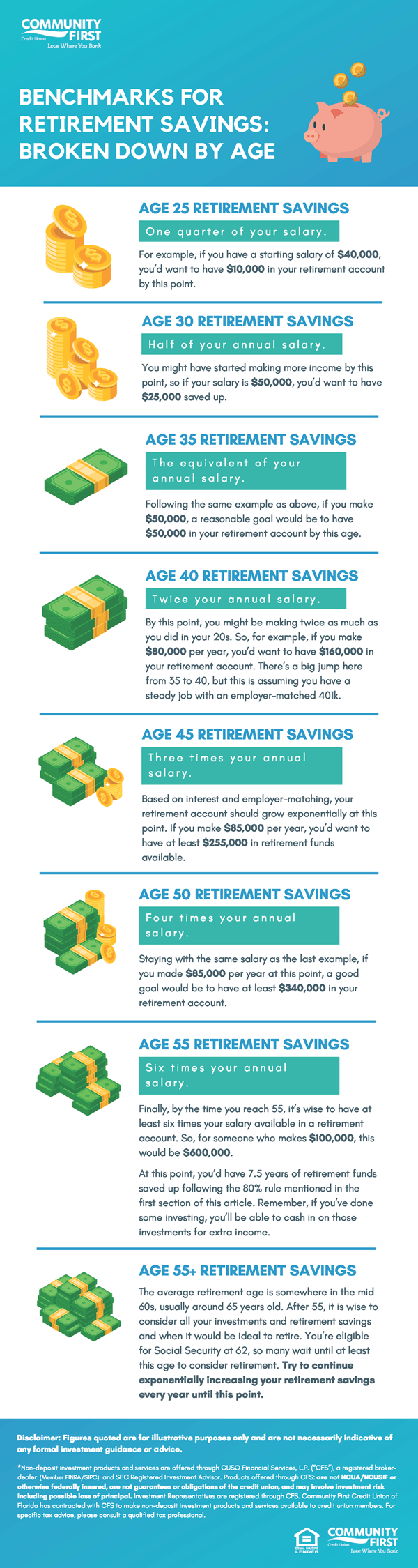

Benchmarks for Retirement Savings by Age

Let’s break these figures down into more practical terms. Keep in mind, these are conservative numbers, and it’s always better to save more. The amounts suggested below should be considered the lowest suggested amounts for retirement savings, and most will want to increase these numbers for a more comfortable lifestyle.

Age 25 Retirement Savings

One quarter of your annual salary. For example, if you have a starting salary of $40,000, you’d want to have $10,000 in your retirement account by this point.

Age 30 Retirement Savings

Half of your annual salary. You might have started making more income by this point, so if your salary is $50,000, you’d want to have $25,000 saved up.

Age 35 Retirement Savings

The equivalent of your annual salary. Following the same example as above, if you make $50,000, a reasonable goal would be to have $50,000 in your retirement account by this age.

Age 40 Retirement Savings

Twice your annual salary. By this point, you might be making twice as much as you did in your 20s. So, for example, if you make $80,000 per year, you’d want to have $160,000 in your retirement account. There’s a big jump here from 35 to 40, but this is assuming you have a steady job with an employer-matched 401k.

Age 45 Retirement Savings

Three times your annual salary. Based on interest and employer-matching, your retirement account should grow exponentially at this point. If you make $85,000 per year, you’d want to have at least $255,000 in retirement funds available.

Age 50 Retirement Savings

Four times your annual salary. Staying with the same salary as the last example, if you made $85,000 per year at this point, a good goal would be to have at least $340,000 in your retirement account.

Age 55 Retirement Savings

Six times your annual salary. Finally, by the time you reach 55, it’s wise to have at least six times your salary available in a retirement account. So, for someone who makes $100,000, this would be $600,000.

At this point, you’d have 7.5 years of retirement funds saved up following the 80% rule mentioned in the first section of this article. Remember, if you’ve done some investing, you’ll be able to cash in on those investments for extra income.

Age 55+ Retirement Savings

The average retirement age is somewhere in the mid 60s, usually around 65 years old. After 55, it is wise to consider all your investments and retirement savings and when it would be ideal to retire. You’re eligible for Social Security at 62, so many wait until at least this age to consider retirement. Try to continue exponentially increasing your retirement savings every year until this point.

Factors to Consider When Saving for Retirement

No matter your age, you can start preparing for retirement now. It’s never too early or too late to start. When you’re thinking about the costs associated with retirement, be sure to keep these considerations in mind:

- Medical Costs – Though there are benefits available, depending on your age, many medical necessities might not be covered, so make sure you consider these expenses when considering your retirement savings.

- Lifestyle – What type of lifestyle do you want when you retire? If you plan on a luxurious retirement, you’ll need to save more. If you’re comfortable with a more modest approach, you’ll have more room to be flexible with your savings.

- Retirement Age – What age would you like to retire? If you’re young, you can consider retiring early, though drawing from some accounts before a certain age has penalties. Make sure you are aware of all the ins and outs of your 401k, IRA, and other savings accounts.

Helpful Tools for Retirement Savings

At Community First, we want to help you effectively prepare for retirement, so we’ve put together some easy-to-use calculators to help you visualize your savings.

Your Retirement Lifestyle

From the size of your home to how often you want to travel, use this tool to figure out how much you’ll need to save to support the retirement lifestyle of your dreams.

Planning for Retirement Expenses

It can be difficult to visualize exactly where your money will go in retirement, which is why we put together this calculator, which can help you determine how much you’ll need to save based on your estimated retirement expenses.

Want to Learn More? Check out our helpful Investment Services web page for more information or check out the infographic below.

Still have questions?