Find out if a Debt Consolidation Loan is Right for You

Updated 10/29/2025

Jump To:

- What is Debt Consolidation?

- Signs You May Be Ready for Consolidation

- Benefits of Consolidation Loans

- Example of Debt Reduction

- How it Works & Applying

- How to Prioritize Debts to Pay

- Debt Consolidation Options

- Credit Score

- Is it Right for You?

- How Debt Payoff Works

- Benefits of Community First Loans

Ready to let go of some of that debt? Whether it is high-interest credit card debt from your summer vacation, back-to-school shopping, or simply debt that’s built up over time, debt consolidation can offer a solution. Organize your debt to make it easier to pay while reducing the overall costs. Here’s what you can expect.

What Is Debt Consolidation?

The simplest description of debt consolidation is an opportunity to roll most of your existing debt into one, single monthly payment. You can include high-interest loans, credit card debt, and other debts you owe. Several types of debt consolidation exist, but in most situations, it involves obtaining a new loan to pay off your existing loan.

Signs It May Be Time to Consider Debt Consolidation

- A significant portion of your monthly income is going toward debt payments. Learn more about debt-to-income ratio.

- You are overwhelmed with your financial situation

- Your paycheck runs out before your bills are paid

- You often forget to pay certain bills

- Credit card balances are significantly increasing despite making regular minimum payments

- Frequent overdrafts on your account

- Using savings or retirement accounts to cover expenses

What Are the Benefits of Debt Consolidation?

Many people spend nights awake worrying about how they will pay each one of their bills. Yet, paying the monthly payment on your debts means you’ll be paying back money for years, sometimes even decades. Instead, consider how debt consolidation can work to help you pay off your debt faster and often for significantly less money.

Benefits of debt consolidation include:

- Streamlined finances: you only have to pay one debt bill as opposed to several

- Lower interest rates: Debt consolidation loans often come at much lower interest rates. For example, depending on a person's credit worthiness, they could be paying 29.99% interest on a credit card balance every month. Alternatively, a personal loan at a rate of 9.99% would create a dramatic reduction in the debt owed, and reduce its compounding effect.

- Lower monthly debt payments: Consolidating high interest debt into a lower rate loan can reduce the monthly payment, making debt repayment more budget-friendly.

- Improved credit score: Paying off balances and reducing your overall debt-to-income ratio can help improve your credit score.

- Faster debt repayment: Reducing interest payments, means more of your monthly payment goes toward reducing the principle balance, which reduces the amount of time it will take to pay the debt off.

- Peace of mind: Knowing that you have consolidated your debts into one manageable payment can provide peace of mind and a sense of accomplishment.

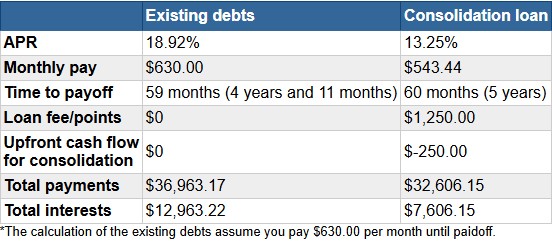

How Much Can a Debt Consolidation Loan Reduce My Debt?

A debt consolidation calculator offers the quickest way to visualize how much you will pay on a consolidation loan versus paying current debts. A consolidation calculator allows you to compare current balances, interest rates, and payment amounts of existing debts to the consolidation loan's interest rate, payoff period, and monthly payment. To get an idea of your current debt situation, and whether debt consolidation is right for you, try one of these calculators. Below is a visual example of a how a debt consolidation loan can reduce debt**:

Source: Calculator.net

How Does Debt Consolidation Work?

Debt consolidation requires you to apply for and obtain a new loan. Then, the proceeds from this loan are used to pay off your existing debt. It’s a fast and easy way to get the help you need. Debt consolidation loans, or unsecured loans, often have much lower interest rates. Before applying for a loan, check interest rates that different lenders are offering. Community First Credit Union of Florida, for example, offers competitive rates.

General documents you will need to apply for a consolidation loan are:

- Valid government-issued photo ID such as a United States Driver's License, Permanent Resident Card, or United States Passport.

- Proof of income to demonstrate your ability to repay the loan.

- Proof of residence such as a utility bill or lease agreement showing your current address.

- Information on the desired loan amount and preferred loan terms.

Additional documentation may be required based on your specific financial situation or loan type.

How to Prioritize Debts to Pay First

Depending on your financial situation, it is often beneficial to priortize the following debts first:

- High interest rate debt: To reduce the debt's ability to compound, it is beneficial to pay off high interest rate debt first. Some credit cards have interest rates of nearly 30%.

- Unmanaged or deliquent debt.

- Learn more about which types of debt are eligible for consolidation

Debt Consolidation Options

- Personal loans (unsecured loans)

- Home equity loans

- Cashout auto refinance options

What Credit Score is Needed to Qualify for a Debt Consolidation Loan?

This is a common question people ask before researching or applying for debt consolidation. Each lender has different requirements, but Community First Credit Union of Florida does not have a specific credit score requirement to qualify. If you are unsure if debt consolidation is right for you, or you have poor credit, it is most helpful to have a conversation with a personal banker who can find a solution that works for you.

Is Debt Consolidation the Right Option for Me?

If you are unsure whether your financial situation is best handled with debt consolidation, you can start by using our debt consolidation calculator to determine what you can expect from a new loan. Enter the information required and see just how much you could pay a month through consolidation.

If you have become overwhelmed with your financial situation, or your monthly budget is becoming unmanageable due to debt payments, it may be best to speak with a loan specialist. Community First Credit Union of Florida offers personalized solutions that can help get your finances back on track.

Contact us:

- Call 904.354.8537 to be connected with our relationship team.

- By visiting a branch near you. Find a branch.

How Does Debt Payoff Work?

Applicants commonly ask: "How do I pay off my debt after I am approved for debt consolidation?" This can vary depending on your type of debt, how much debt you have, and the financial institutions involved. Generally there are two options for how debts will be paid off with a consolidation loan:

- The financial institution pays the debt directly

- The financial institution offers "cash out" of the loan funds, and the individual pays the debt

- A combination of the two

What are the benefits of a debt consolidation loan at Community First Credit Union of Florida?

- Low interest rates

- Flexible terms

- Loans approved same-day

- No origination fees

Debt consolidation is an opportunity to save money for many people. Having all or much of your debt in a single, fixed, low-interest loan that you can afford to pay easily each month. It makes it easier to meet your financial goals and, over time, making those payments on time can even help you boost your credit score.

Ready to learn more? Check out our current debt consolidation loan options.

*All loans and accounts are subject to approval. All rates are based on an evaluation of the member’s individual credit history. Terms are subject to conditions and verification and restrictions may apply. All credit union program, rates, terms and conditions are subject to change at any time without prior notice.

**All information contained in this blog is for informational purposes only. The credit union makes no representations as to the accuracy, completeness, suitability, or validity, of any information. The credit union is not responsible for any errors, omissions, or any losses, injuries, or damages arising from its display or use. All information is provided AS IS and with no warranties and confers no rights. The credit union is not responsible for material that is found through non-credit union links posted on this blog site. Ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

More Debt Management Tips from Community First

- Examples of Good and Bad Debt

- How to Get Rid of Credit Card Debt

- How to Reduce Student Loan Debt

- How to Pay off Holiday Debt

- Loans Eligible for Debt Consolidation