Breaking Down An Auto Loan & Calculating Interest

Updated August 2025

If you are considering buying a car, a few key pieces of information will empower you when it is time to talk about financing. By breaking down the parts of a car loan, you can get an idea of what your payment will be and just how much interest you will pay. By doing your homework before you hit the car lot, you can have more control over what you are willing to pay in principal and interest.

Auto loans can be broken down into three basic parts:

- Principal: The amount you borrow is determined by the cost of the vehicle.

- Interest: The annual percentage rate (APR) determines what you pay in addition to what you borrowed.

- Term: The length of time to pay back the loan. Auto loans generally last between three and seven years.

Interest rates change often, and they are an important determining factor in car affordability. To gain clarity about how the interest rate can affect your monthly payment and how much you will pay back in total, take the time to calculate a few options for yourself. Here are two ways you can calculate what you will pay back on a car loan.

How to Calculate Total Car Loan Interest

1. Use Excel:

If you want to know how to calculate interest on a car loan in Excel, go to the 'formulas' tab, look in financial formulas, and use the 'PMT' formula. PMT stands for payment and it calculates the payment for a loan based on constant payments and a constant interest rate.

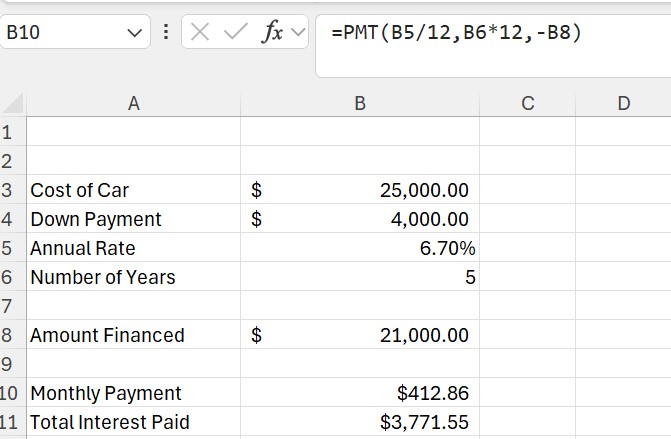

This Excel formula can be used with any principal, rate, or term. For an example, a $25,000 car financed for 5 years with a 6.70% interest rate will mean you pay $3,771.55 in total interest. To arrive at this result, see our Excel example:

=PMT(B5/12,B6*12,-B8)

Result: $412.86

To calculate the total interest paid on the car loan, use this Excel formula:

=B10*12*B6*-B8 or =$412.86*12*5*-21,000

$3,771.55

If you want to set up your own car loan calculator in Excel for more visibility, this YouTube video gives a clear, step-by-step breakdown.

2. Use a Car Loan Calculator:

To get a quick idea of what your auto loan payment will be, use our auto loan calculator. It is important to note that car payment calculators do not necessarily reflect final payment information. They are best used to estimate and compare cars and loan options. Calculators also depend on what you input and the results can vary based on the formula used.Consider the following things that can offset the figure you arrive at with different calculators:

- Sales tax (and whether it applies before or after trade-in value)

- Additional taxable and non-taxable fees

- Down payment and trade-in value offsets

Many calculators use the standard loan amortization formula.

Breaking Down the Parts of a Car Loan

Principal

The principal is the total amount borrowed from the lender. As it applies to an auto loan, it’s the cost of the vehicle minus the down payment. The more of a down payment you make, the less you’ll have to borrow, which can lower how much you pay in interest.

When making a down payment, try to put down at least 20% for a new vehicle purchase, and at least 10% for a used one.

Interest Rates

Interest rates can be either fixed or variable. Fixed rates will stay the same for the length of the loan term while variable rates will adjust according to the markets at certain intervals. Auto loans are commonly fixed-rate loans and can be refinanced later if rates get lower.

Here are the factors that affect the rate on an auto loan:

- Your credit score: The higher your credit score, the better your chances of a lower interest rate.

- The loan term: The shorter the term, the lower the rate and the lower amount of interest needing to be paid.

- The loan amount: Many lenders have minimums on the amount borrowed depending on the length of the loan term.

- Age of the vehicle: The older the model, generally the higher the interest rate.

- The lender: Financial institutions will offer their rates. Credit unions typically have lower rates compared to for-profit lenders.

Dealerships will have their own financing departments to offer convenient auto loans on-site, but their rates tend to be higher than what you can get from banks, credit unions, or online lenders. You can have more control in your car-buying experience if you get a loan through your credit union, using an auto loan express draft. This option from Community First Credit Union, is the equivalent of shopping as a cash buyer because you already have approval for what you can afford, and your interest rate is set. Learn more about the auto loan express draft at Community First.

For borrowers with a lower credit score or no credit history, a co-signer can improve their chances at approval and a lower interest rate. This is helpful for first-time car-buyers.

Loan Term

The term of the loan is the amount of time you must repay the loan. If you pay off the loan sooner than the agreed-upon date, some financial institutions carry a prepayment penalty.

The length of the loan determines how long you’ll be paying interest and how much money you’ll be paying back monthly. If you can afford higher monthly payments, having a shorter loan term means paying less in interest and saves you money overall. A longer loan term can help free up money with a lower monthly payment, but you’ll be paying more in interest.

Other Factors to Consider for an Auto Loan

In addition to the amount borrowed and the interest payments, there are other fees that’ll add cost to the bottom line. These can include origination fees and prepayment penalties.

Refinancing an auto loan to a lower interest rate can add to the loan term and incur new fees since it’s a brand-new loan. The new fees can be potentially offset by the lower interest rates.

Additional Auto Loan Help

Hopefully, you have a better understanding of how auto loans are structured and how much you’ll be paying back. For additional assistance, call our auto loans express team.

Learn More About Auto Finance

- How to Qualify for a Car Loan

- How Much Car Can You Afford?

- How to Lower Your Car Payment

- Loan Terminology to Know

- Factors that Affect Auto Loan Rates

- RV Financing in Florida